city of cincinnati tax forms 2021

Join by phone 1 929 436 2866 _____. Fourteen states including Ohio allow local governments to collect an income tax.

Tax Forms Marysville Oh Official Website

City Hall Building 40 West Main Street 2nd floor Newark OH 43055 Main Engineering Phone.

. Meetings are open to the public and livestreamed on our YouTube Channel. Cash Payrolls Luxury Tax Payrolls. In accordance with the Ohio Revised Code the Hamilton County Treasurer is responsible for collecting three kinds of property taxes.

Upon entering City Hall social distancing is encouraged and masks are optional. Taxes on real estate are due in January and June of each year. Kansas City MO 64999-0002.

Regardless of the tax forms you used to file your tax return with you must mail Form 1040 along with the attachments to the Internal Revenue Service. Are there any changes in Form 940 for the 2021 tax year. Real Estate Tax Information.

One such form that we support is Form 941 Employers QUARTERLY Federal Tax Return. Box 7704 San Francisco CA 94120-7704. Wages paid after the end of the calendar year may be used only to figure the credit claimed on the following years tax return.

For example if your tax year began on April 1 2020 and ended on March 31 2021 you must figure wages based on the calendar year that began on January 1 2021 and ended on December 31 2021. Sanitary Sewer Emergency - 3083855432. For the 2021 tax year the US Virgin Islands are a Credit Reduction State with a rate of 33.

ElectricWater Emergency - 3083855461. City Hall Main - 3083855444. StreetStorm Sewer Emergency -.

The current Luxury Tax Threshold is 136606000. For amended IRS returns see tax amendment mailing addressesIn case you have to mail in current year IRS Tax Forms find them via this link. 513-352-2546 513-352-2542 fax taxwebmastercincinnati-ohgov.

What is a local income tax. To 430pm Monday through Friday excluding Holidays The Division of Engineering is located on the second floor of City Hall and. For state return mailing addresses find the respective addresses via the link.

A local income tax is a special tax on earned income collected by local governments like counties cities and school districts. Internal Revenue Service PO. 1040X Tax Amendment Mailing Address.

Where to Mail A 2019 Tax Return. TaxBandits is an IRS authorized e-file service provider that supports various IRS tax forms. 2025 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011.

Employers use Form 8850 to pre-screen and to make a written request to the state workforce agency SWA of the state in which their business is located where the employee works to certify an individual as a member of a targeted group for purposes of qualifying for the work opportunity credit. States that have not repaid the amount taken as loans from the federal government to meet its state unemployment benefits liabilities come under Credit Reduction State. The Cincinnati Fire Department strives to quickly restore normalcy to its customers lives by responding to their needs in an expeditious manner The Cincinnati Fire Department was organized in 1853 and is the nations oldest fully paid professional fire department which is why we are proud to be First in the Nation.

Click on the state you live or reside in -. With TaxBandits you can securely e-file Form 941 in a few minutes. Or reside in - most likely the same address as on your tax return - below and find the mailing address for your IRS tax forms.

450306 and personal property ORC. All City Council Meetings begin at 6 PM as of December 2021 unless otherwise stated. Department of the.

The 2022 eFile Tax Season for 2021 Tax Returns starts in January 2022. Alaska California Hawaii Washington. 32312 manufactured homes ORC.

740 670-7727 Zoning Phone. Bi-Annual Exception Details is available to any teams who are below the Luxury Tax Apron 156938000 and did not use this exception in the previous. If you have zero tax amount to report on your Form 941 we have a special feature for you to save a lot of time during the.

740 349-5911 Office Hours. And taxes on manufactured homes are due in. Income Tax Office 805 Central Ave Suite 600 Cincinnati OH 45202.

Non-Taxpayer Mid-Level Exception Details is awarded annually to teams who are above the cap but below the Luxury Tax Apron 156938000 and can be used for contracts up to 4 years in length. The IRS mailing addresses listed below can also be stored. Do not mail your state tax returns to any of the addresses listed below.

While the federal income tax and the Ohio income tax are progressive income taxes with multiple tax brackets all local income taxes are flat-rate. Engineering Zoning Division Contact Information.

New Year Brings New Old Rules For Ohio Municipal Income Tax Withholding By Employers Law Bulletins Taft Stettinius Hollister Llp

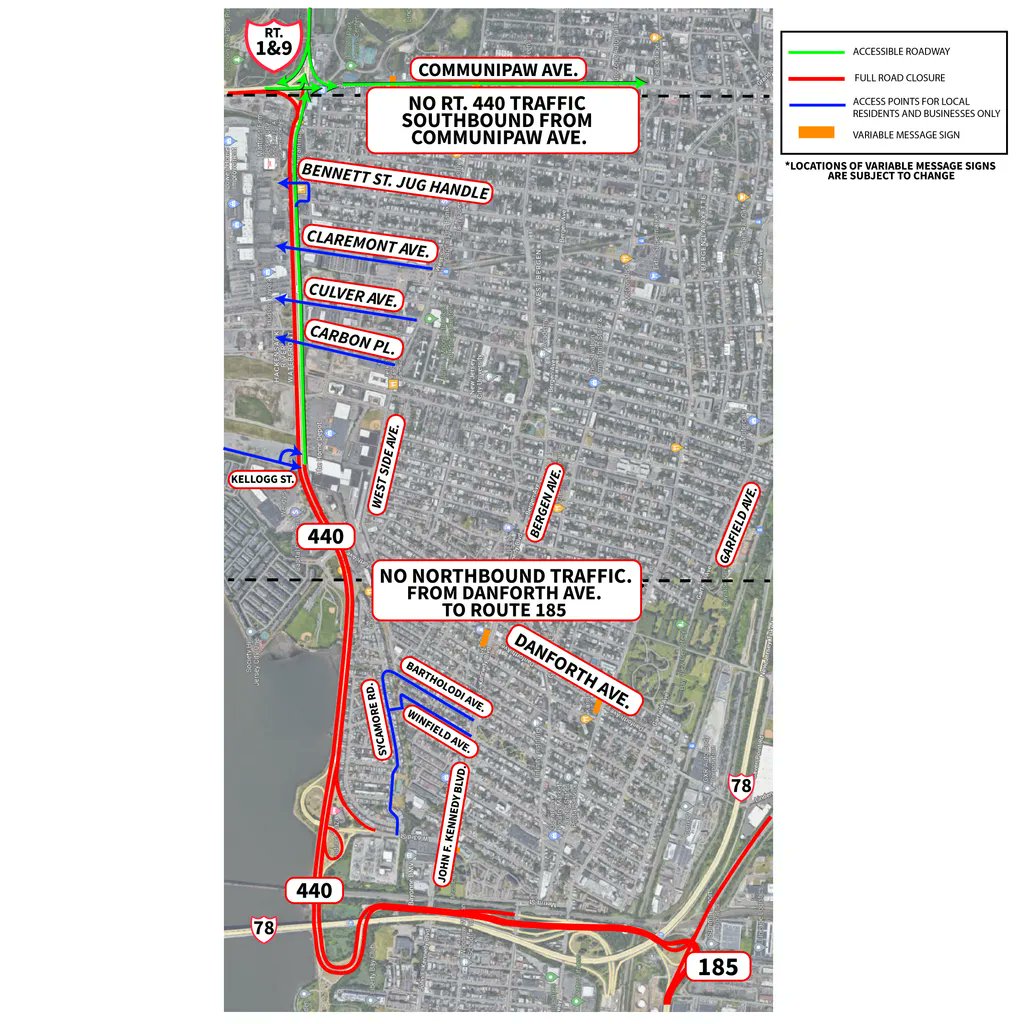

Newark Nj Historic Preservation Newark New York Travel

Cities With The Lowest Tax Rates Turbotax Tax Tips Videos

How Ohio S New Municipal Income Tax Withholding Requirements Impact Work From Home Arrangements Walter Haverfield

Cincinnati Reserves 50m For Remote Worker Tax Refunds Wvxu

New England Patriots 3d Hoodie New England Patriots Hoodie Patriots Hoodie England Patriots

Income Tax Changes Work From Home Could Have Big Impact On City Budgets

Ohio Workers File For Local Municipal Income Tax Refunds On Returns

Denver Colorado Map Denver Co Map Denver City Map Denver Etsy

Paid Income Tax For A City You Didn T Work In 2021 Here S How To Get Your Refund Cleveland Com

Ohio Workers File For Local Municipal Income Tax Refunds On Returns

Tax Impact 80 Who Work In Dayton Live Outside Of The City

Ohio Tax Talk Adjusting To The Latest Telework Tax Rules Frost Brown Todd Full Service Law Firm